Overview

The following disclosures are in fulfilment of the requirements of Part 8 of the Financial Services (Investment Firms) (Prudential Requirements) Regulations 2021, which came into force on 1 July 2022.

Risk Management objectives and policies

Argon Financial Limited (“the Firm”) has undertaken a comprehensive review of its Risk Management architecture, under the Enterprise Risk Management framework. This has included reviewing the Firm’s objectives and policies to ensure they align and reflect the ideals of the Firm, market best practice, and regulatory compliance. This review has covered all aspects of the business, including the monitoring and risk controls with respect to capital requirements, concentration risk, and liquidity risk, strategy, and risk profile as part of the Enterprise Risk Management framework.

The purpose is to enhance the structure going forward to place the business on a stronger footing for organic growth, benefiting our clients with improved services and risk management controls. The Firm has revised its Enterprise Risk Policy to reflect the latest market best practices and regulatory expectations. This includes a concise risk appetite statement, confirming the Firm’s prudent attitude to risk. These initiatives support the Firm with a robust Risk Management control environment and demonstrate management’s commitment to ensuring the Firm is run with high standards of Risk Management and corporate governance, thus assuring investors of a well-run and established institution.

Risk appetite statement

The Firm will not accept risks that are determined as ‘High’ post mitigation and controls. Further controls would need to be implemented or the business or process will not be undertaken, as it would fall outside the Firm’s Risk Appetite.

In addition, the Firm has a zero tolerance towards financial crime, including but not limited to money laundering, fraud, market abuse, terrorist financing, and bribery and corruption.

Governance

As with Risk Management, the Firm has reviewed its Corporate Governance arrangements. This has included a review of the structure of board committees, their terms of reference, and management meetings to align with proper oversight of the Firm’s activities, ensuring compliance with policies, regulatory obligations, and market best practices.

The Firm has a dedicated Risk Management forum, which reports to a Board Committee quarterly and a Management Meeting monthly. This allows the Board and management body to address any concerns that need to be reported.

The number of directorships held by each member of the Board and management body in Gibraltar at 31 December 2023 was as follows:

- A T McGrath (3)

- S R Brown (1)

- M C Leadbeater (2)

- J M Wilson (2)

- J C Page (2)

- B S Kelly (2)

The composition of the Board and management body reflects the Firm’s adherence to diversity. The Firm encourages diversity and recruits members based on skills and experience, regardless of gender, ethnicity, or other factors.

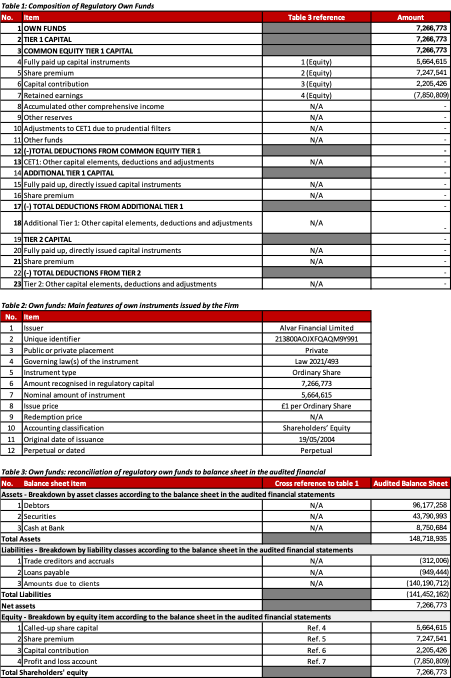

Own Funds

The Firm continues to meet the Own Funds as set out in the regulatory standards. All the necessary deductions have been applied in determining Own Funds.

The Firm’s Own Funds at 31 December 2023 were £7.3 million, equating to its audited Net Assets. No deductions from Net Assets have been deemed necessary.

The Firm’s Own Funds is made up entirely of Common Equity Tier 1 capital. The Firm does not have any Additional Tier 1 or Tier 2 Capital. The Firm’s Common Equity Tier 1 capital is made up of fully paid up shares.

No restrictions have been applied to the calculation of Own Funds.

The following tables present the Firm’s own funds composition, the main features of its capital instruments, and a reconciliation of own funds to the audited balance sheet as at 31 December 2023. All amounts are in GBP.

Own Funds Requirements

The Firm’s prudential classification is as a Class 2 Investment Firm.

The Firm’s Own Funds requirements have been comfortably met and the Firm continues to improve its financial performance. Management will continue to recommend to the Board that any surplus funds generated will continue to be added to reserves for the foreseeable future in order to continue strengthening the Firm’s Own Funds. The Firm has consistently performed within its Own Funds requirements.

The Firm’s approach to assessing the adequacy of its internal capital to support current and future activities is undertaken through a budget based on appropriate estimates of costs to sustain the business and grow against expectations. This is also done through the ICARA process, where Risk Management plays an integral role in allocating capital against future risks. The Board reviews the Firm’s capital surpluses and actual results against budget quarterly.

The Firm Own Funds Requirements have been determined by following the Investment Firms Prudential Regime (“IFPR”) three-pillar approach:

- Pillar 1 – minimum regulatory capital, liquidity buffer, and concentration risk limits

- Pillar 2 – the ICARA (which forms the basis for any capital add-ons)

- Pillar 3 – disclosure and reporting requirements

Pillar 1 – Minimum capital requirement

The minimum capital requirement is the higher of the ‘permanent minimum capital requirement’, ‘fixed overhead requirement’, and ‘K-Factor requirement’.

The permanent minimum capital requirement acts as a floor for all levels of capital required under the IFPR and must be at least the initial capital requirement. Alvar’s initial capital requirement is £750,000.

The Fixed Overheads Requirement (“FOR”) should be at least one quarter of the fixed overheads of the preceding year (2023). The Company’s FOR has been calculated at £2,355,788.

The IFPR uses quantitative indicators (“K-factors”) to target business practices likely to generate risks for investment firms. K-factors are divided into three groups to capture risks posed to clients (Risk-to-Client (“RtC”)), market access (Risk-to-Market (“RtM”)), and the firm itself (Risk-to-Firm (“RtF”)).

At 31 December 2023, the Firm’s aggregate K-factor requirement was £3,797,000, made up of RtC £591,000, RtF £2,676,000, and RtM £530,000.

Pillar 2 – ICARA

The Firm maintains a comprehensive Risk Register of all risks it may face. Each risk has undergone an inherent risk assessment (considering probability of occurrence and financial impact) to determine its Inherent Risk Score and is then assigned controls from the Firm’s Control Risk Framework to determine its Residual Risk Score and, finally, the Residual Financial Cost (i.e., its Pillar 2 capital requirement).

The Risk Register generates a Pillar 2 capital requirement of £667,875 across all risk areas.

Overall Capital Adequacy Position

K-Factor requirement: £3,797,000

Fixed overhead requirement: £1,411,727

Permanent minimum capital requirement: £750,000

Minimum Capital Requirement (Pillar 1): £3,797,000

Pillar 2 (ICARA – Risk Register): £667,875

Own Funds Threshold Requirement (Pillar 1 + Pillar 2): £4,464,875

Remuneration policy and practices

The Firm’s pay strategy is designed to reward competitive, long-term sustainable performance and to attract and motivate the best people, regardless of gender, ethnicity, age, disability, or other factors unrelated to performance or experience, in alignment with the long-term interests of our stakeholders.

Effective governance of the Firm’s remuneration practices is key. The design and implementation of remuneration policies are overseen by the Remuneration Committee to ensure pay aligns with the Firm’s business performance and strategy. Performance is judged on both achievements and how they are achieved, with the Firm believing that the latter contributes to long-term sustainability. The remuneration framework focuses on total compensation (fixed and variable pay), with variable pay (bonus pools and annual incentives) differentiated by performance, conduct, and adherence to the Firm’s values.

The Firm’s remuneration arrangements are designed to:

- Be consistent with and promote sound and effective risk management

- Not encourage risk-taking inconsistent with the Firm’s risk profile

- Not impair compliance with the Firm’s duty to act in clients’ best interests

All remuneration paid to staff in 2023 was in cash (other than workplace pension contributions and benefits like health insurance and life assurance). The Firm does not award deferred remuneration.

Remuneration for 2023, split between material risk takers (“MRTs”) and non-MRTs:

| MRTs | Non-MRTs | |

| Number of staff | 2 | 5 |

| Total fixed remuneration | £0.3 million | £0.3 million |

| Total variable remuneration (all cash) | £0.0 million | £0.0 million |

| Proportion of total variable remuneration deferred | 0% | 0% |

No severance payments were awarded in 2023.

Neither Regulation 85(6) nor 85(7) apply to the Firm.

Investment Policy

The Firm does not meet the criteria set by Regulation 85(6) and is exempt from Investment Policy disclosures.

Environmental, social and governance risks

The Firm is committed to promoting social diversity and rewarding staff based on contribution, regardless of background. The Firm encourages a prudent approach to risk-taking, ensuring risks are managed within its prudent risk management objectives.

The Firm has undertaken work to review and enhance the sustainability of its services, particularly those offered to clients in the retail sector, in line with Consumer Duty responsibilities. The Firm ensures clients’ financial and social wellbeing is prioritized and will continue to develop these arrangements as best market practices evolve.